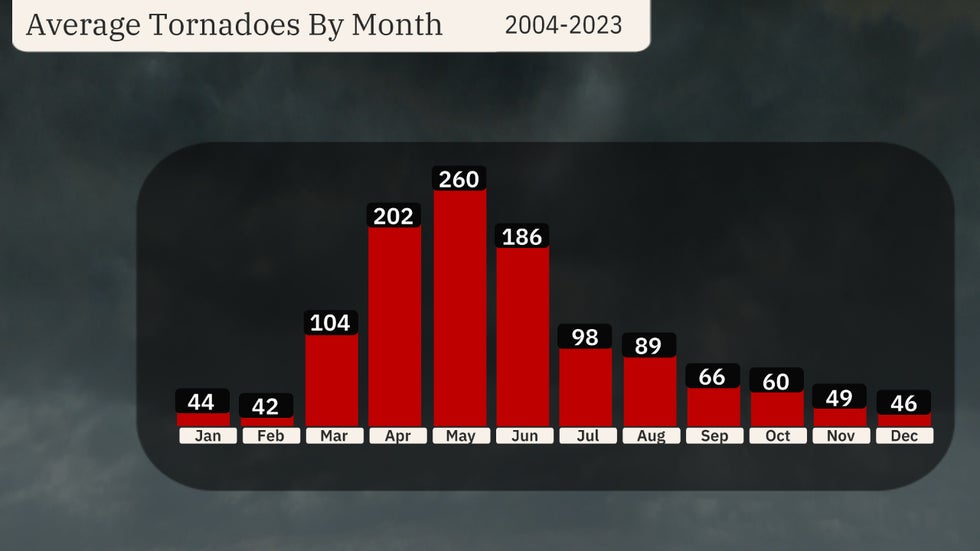

TEXAS PEAK TORNADO MONTH

We can’t always predict the path of a tornado, but we can prepare. And when it comes to protecting your home or business, being informed and covered ahead of time makes all the difference.

Safety Tips to Protect Your Family & Property

For Homeowners

For Businesses

• Assemble an emergency kit with water, non-perishables, first aid supplies, flashlights, batteries, and important documents.

• Secure outdoor items (furniture, grills, etc.) that could become projectiles in high winds.

• Trim trees and branches near your home to prevent damage.

• Stay informed by signing up for local weather alerts or using NOAA weather radios.

• Back up your data off-site or in the cloud in case of damage to your physical location.

• Reinforce windows and doors and consider impact-resistant glass for high-risk areas.

• Review your business continuity plan, including how operations will resume after a storm.

• Inspect and maintain your building’s roof and foundation to reduce structural vulnerabilities.

What Insurance Does—and Doesn’t—Cover

Homeowners Insurance

Commercial Insurance

• Flooding caused by storms is typically not covered unless you have a separate flood insurance policy.

• If your policy has actual cash value instead of replacement cost, you may receive less for damaged property.

• Ensure your policy includes business interruption coverage to help offset lost income during downtime.

• Review limits on equipment or inventory coverage—you may be underinsured if you’ve grown recently.

• Double-check your deductibles for wind or named storms, which can be higher in high-risk areas.

How Tower Street Can Help

Our Team Provides

• Gap analysis to identify missing or outdated policies

• Support with risk mitigation strategies

• Fast, responsive claims assistance when it matters most

Reach out to our team for a personalized risk assessment or policy review. We’re here to give you clarity, confidence, and the coverage you need during tornado season and beyond.

🔹 Primary Tower Street Claims Contact

Call your dedicated Claims Advisor or the main line at (972) 472-8755 to report the incident.

We’ll walk you through the next steps and coordinate with your carrier.

🔹 Account Manager or Producer

They can support you with immediate documentation, employee benefit coverage questions, and ongoing risk management.

If you’re unsure who your point of contact is, email info@dev-tower-street-insurance.pantheonsite.io/ and we’ll connect you with the right person.

🔹 Loss Control Team

Our Loss Control experts will help conduct a root cause analysis, advise on corrective actions, and provide recommendations to prevent future incidents.