Fire Season is Here

Protect Your Home & Business from Risk

Overview

As Texas enters peak fire season, it is crucial to understand the risks, how to secure your property insurance, and a plan of action. Many homeowners and business owners may not be fully aware of the necessary safety measures to reduce risk and protect what matters most. Safeguarding your home, business, and finances is essential—not just for personal security but also for the well-being of your community.

Protection Steps

1. Create a defensible place

Clear off any dry vegetation, leaves, and debris at least 30 feet away from buildings to reduce fuel for fires. Regularly trim overgrown grass, remove dead plants, and store firewood away from structures.

2. Use fire-resistant materials

Opt for non-combustible materials for your roof, siding, and fencing to reduce the risk of embers igniting your property. Enhance protection further by installing tempered glass windows and fire-resistant doors, creating an extra barrier against heat and flames.

3. Have an emergency plan

Establish clear evacuation routes and meeting points for family members or employees, ensuring everyone knows where to go in case of an emergency. Maintain open lines of communication by setting up a system to stay informed, receive updates, and check in with one another during an evacuation.

4. Check your insurance coverage

Make sure your homeowner’s or commercial property insurance includes wildfire coverage and provides adequate protection for your home, business, and belongings. Tower Street can help assess your policy, identify any gaps, and recommend the right solutions to keep you covered.

5. Install fire-resistant vents & screens

Ember-resistant vents on roofs and attics help prevent sparks from entering and igniting your home or business. If you have a grill near a wooden fence, placing a fire safety sheet can create a protective barrier.

6. Back up important documents

Store key business and personal documents in a fireproof safe to protect physical copies, and use a secure cloud system for digital backups. This extra layer of security can help safeguard essential information and make recovery easier after a disaster.

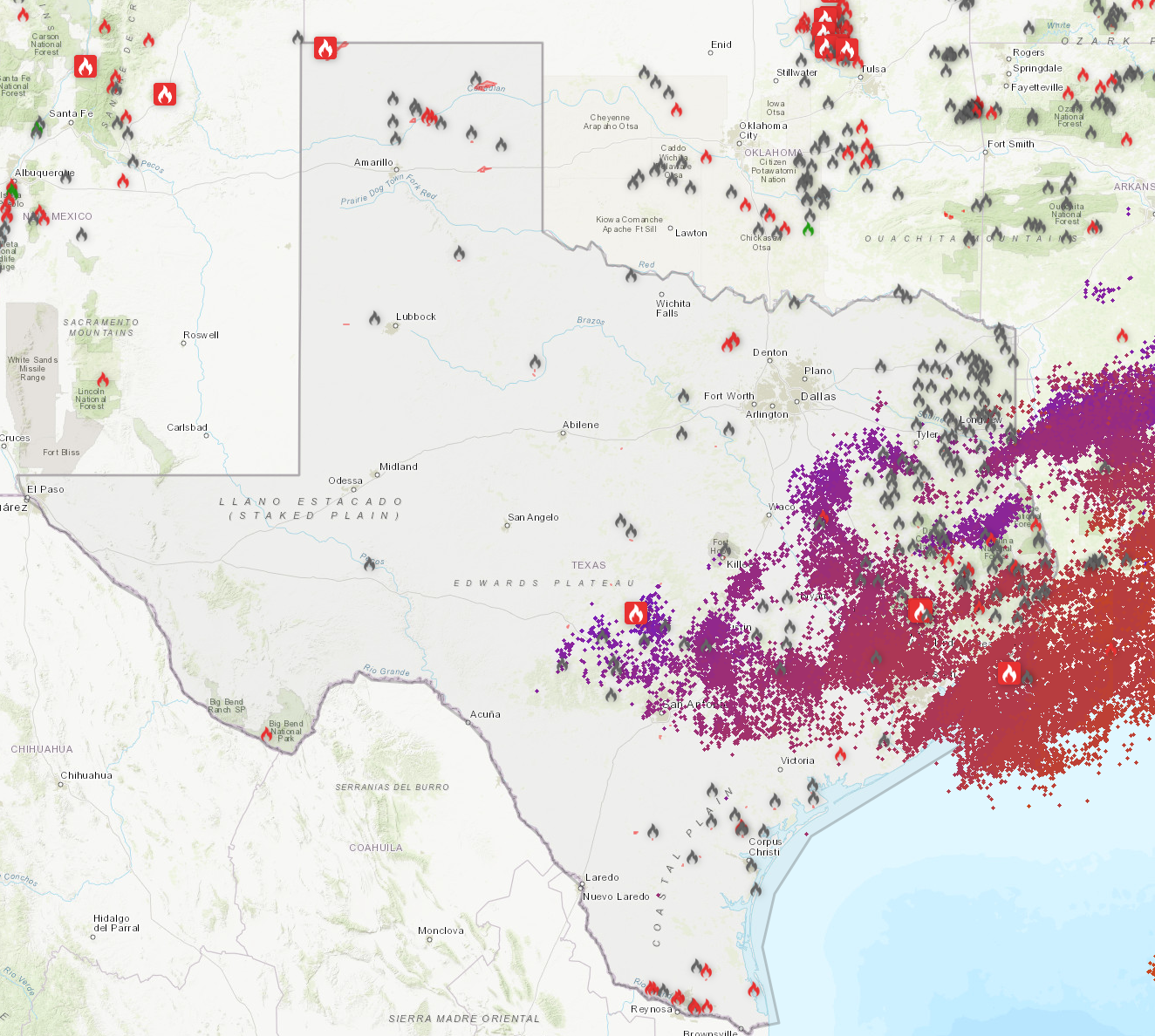

Wildfire Map

Fire Insurance v Wildfire Insurance

Fire insurance generally refers to protection against accidental fires (like kitchen fires or electrical issues) and is typically included in standard homeowners or commercial policies.

Wildfire insurance covers damage caused by natural wildfires, and although often included under fire protection, it may have limitations or exclusions—especially in wildfire-prone areas like parts of Texas.

That’s why it’s critical to review your policy carefully or speak with a licensed expert to confirm you’re protected against all fire-related risks.

Understanding Fire Insurance for Homeowners and Business

Homeowners

- Wildfire damage is typically covered under standard homeowners’ insurance, but limits vary.

- Review your dwelling coverage to ensure it covers full rebuilding costs.

- Check personal property coverage to replace belongings lost in a fire.

- Ensure your policy includes additional living expenses (ALE) to cover temporary housing if your home is uninhabitable.

- Some wildfire-prone areas may require additional endorsements or separate wildfire policies—verify with your insurer.

Business Owners

- Commercial property insurance usually covers wildfire damage to buildings, equipment, and inventory.

- Business interruption insurance is crucial—it helps replacing lost income if operations are shut down.

- Consider coverage for temporary relocation, payroll protection, and extra recovery expenses.

- Verify coverage limits to avoid financial gaps during recovery.

Educate yourself on local fire safety codes and emergency protocols. Consider consulting with experts who can help analyze your specific needs.

Homeowners and business owners looking for comprehensive wildfire insurance coverage can turn to Tower Street for expert guidance and tailored solutions.

For more information or on coverage, reach out to our team today.

Whether you need to review an existing policy, find additional protection, or get clarity on wildfire-related coverage, Tower Street Insurance is here to help. We believe in proactive protection and personalized service, ensuring that every client has the knowledge and resources needed to stay prepared.

Contact us today for a personalized consultation and we’ll ansewer any questions you may have.

Call us at 469-788-8888 or email us at admin@towerstreetinsurance.com for expert guidance.

Get a Free Quote to see how we can help you save while staying protected. Choose Tower Street Insurance—where we protect you.